5 Mistakes to Avoid in Self Storage Due Diligence

Oct 20, 2023Due diligence stands as the cornerstone of real estate investment, a pivotal phase where the potential for significant errors looms large. It is during this stage that the imperative lies in the identification of substantial disadvantages, red flags, and potential pitfalls, which can bear substantial repercussions on one's investment. Concurrently, it offers a fertile ground for uncovering opportunities and charting the essential steps required to formulate a comprehensive business plan.

The primary focus of due diligence revolves around rectifying presumptions and proactively averting unpleasant surprises. It is noteworthy that surprises in this context predominantly manifest in adverse forms rather than favorable ones, prompting the question, "How did we overlook these?" The core aim of due diligence is the preemptive mitigation of such oversights, thereby safeguarding one's investment.

This article comprehensively expounds upon our rigorous due diligence process, shedding light on our established methodology. In addition, it underscores the critical components deserving of meticulous attention, alongside the prevalent pitfalls that have the potential to lead to significant complications.

Physical Property Due Diligence

The due diligence process encompasses various phases, and the current focus pertains to the physical property due diligence, particularly on-site assessments. It is imperative to maintain a structured and consistent approach while conducting due diligence at a property. Equally crucial is the systematic documentation of all findings, given that during on-site assessments, crucial details can be inadvertently overlooked, and pertinent questions might go unasked.

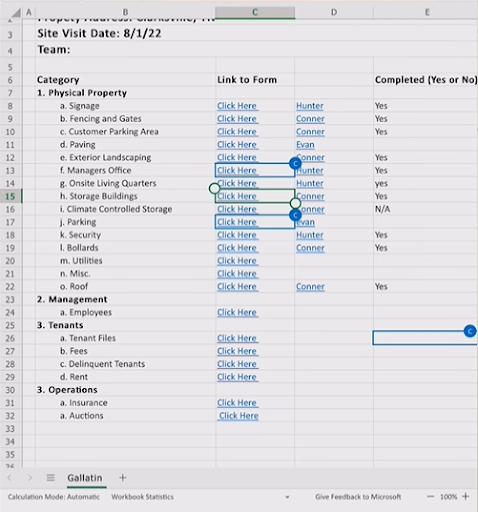

To ensure a methodical approach, we have devised a standardized process. This approach commences upon arrival at the property and entails a systematic walk-through, capturing essential data via an iPad equipped with dedicated forms.

This method not only prompts us to ask critical questions but also facilitates the recording of comprehensive notes, photos, and videos. The data collected is seamlessly transmitted back to our central office, where it can be reviewed in real-time, allowing for follow-up inquiries and convenient access for lenders, investors, and insurance companies.

While standard reports such as property condition reports, ALTA surveys, and phase one assessments are typically mandated by financial institutions, we recognize the need for a more comprehensive examination. Consequently, we delve into granular details, scrutinizing aspects like signage, fencing, gates, customer parking areas, utilities, on-site manager offices, bollards, roofing, and other specific categories within the physical property due diligence process.

Here’s an example below:

It is essential to acknowledge that, despite thorough preparation, there may be instances where certain aspects are overlooked or specific questions remain unasked. To address this, let's explore some common issues that can arise during on-site due diligence.

Rent Roll and Locks

One of the initial steps in due diligence involves a meticulous review of the rent roll and the status of locks on the property units. When obtaining a rent roll from the property management system or any associated documentation, it is imperative to confirm that the units listed as rented are indeed generating income. Surprisingly, discrepancies can arise, where managers or third parties might be leasing units that are not under rent payment agreements. Therefore, aligning the financial data with the actual on-site reality is a crucial task, especially when dealing with a considerable number of units, which is often the case in many multi-facility properties.

The synchronization of records with on-ground activities is an indispensable measure in this regard. This process is vital to ensure the accuracy and transparency of the rental income, especially when dealing with properties featuring a substantial number of units.

Property Condition Reports

A critical aspect of on-site due diligence involves a comprehensive visual inspection of the property, specifically focusing on the roofing. It is essential to conduct a thorough examination to identify any damage to the roof, gutters, and downspouts. A common pitfall in past experiences has been relying solely on property condition reports, assuming that the roofing is in good condition, even when the report indicates that there are five to seven years of expected life remaining.

To mitigate such risks, it is advisable to review property condition reports meticulously. However, this should be supplemented with the expertise of independent professionals. Engage the services of a qualified roofing contractor and a third-party inspector who is not affiliated with the property condition report. Simultaneously, it is crucial to physically inspect the property on-site to ensure the integrity of the roofing, gutter systems, and related components.

Neglecting this aspect can lead to substantial financial burdens and operational challenges, which should be diligently avoided.

Competitor Analysis

Another commonly overlooked aspect of due diligence pertains to the examination of the market and the facility's comparison with its competitors, particularly in terms of quality. In our case, where climate-controlled units are integral, it's crucial to recognize that not all such units are created equal. Therefore, it is imperative to conduct a comprehensive assessment of all competitors in the market, scrutinizing their rates and the quality of services they offer. This evaluation should align with your business plan and the strategic direction you intend to take with the facility.

Whether you are exploring expansion opportunities or considering the optimal utilization of various sections of the property, a thorough analysis of competitors is indispensable. It provides essential guidance on the trajectory you should follow to ensure the facility's success in the market.

Utilities

When scrutinizing utility considerations, there are several critical aspects that warrant attention. This is particularly pertinent in climate-controlled units where power consumption plays a significant role. It's essential to be vigilant about certain factors:

- Unauthorized Power Usage: Inside the facility, many units have plug-ins, and there's a possibility that individuals may tap into these plugs without authorization. Such unauthorized power usage can lead to a substantial increase in utility costs, a factor that demands close monitoring.

- Lighting Controls: In climate-controlled units, it's important to ascertain how the lighting systems operate. Are they manually switched on and off, or are they controlled based on time or motion sensors? Units with lighting systems running 24/7 can contribute significantly to utility expenses. This necessitates careful evaluation, as constant power consumption can lead to inflated utility costs.

- Insulation and Airflow: Insulation is another pivotal aspect, especially if it's subpar. In cases where inadequate insulation exists, you may find yourself expending resources to cool down a climate-controlled facility that's losing heat due to poor insulation. This results in inefficient energy usage and higher utility expenses.

To avoid sudden and substantial utility cost increases, it's crucial to proactively address these issues and make any necessary adjustments to the facility's utility usage practices. This will not only help in cost management but also prevent the need for extensive repairs or overhauls to the electricity systems on-site.

Grading and Drainage Assessment

One common misstep in property assessment is the assumption that the grading and drainage systems are in good order. The erroneous belief that since a property has received permits and inspections for occupancy, these systems are flawless can lead to potential issues. It is crucial to recognize that the grading and drainage of a property are of paramount importance.

Improper grading or drainage can result in the accumulation of standing water, leading to the deterioration of asphalt or any paving system in use. This can cause water-related issues, such as water seeping beneath unit doors. In some cases, water can infiltrate units even with well-constructed doors and seals. We have encountered instances where unit doors are at the same level as the surrounding asphalt, allowing water to enter.

Addressing inadequate grading can be a massive undertaking, often necessitating the complete removal and regrading of the asphalt system. This process can be arduous and costly. To avert such complications, it is prudent to prioritize thorough assessments, including property condition reports and on-site inspections. These proactive measures ensure that grading and drainage are well-executed, thereby preventing future issues and mitigating potential headaches.

Business Plan Validation

A fundamental aspect of the due diligence process is the meticulous examination and validation of the overall business plan and strategy. The focus here revolves around clarifying our objectives, the approach we intend to adopt, and the means by which we plan to achieve them. While on-site, it is imperative to rigorously test these theoretical constructs and assumptions.

Quality alignment with pricing is a critical facet of this validation. It entails a comprehensive market assessment, considering factors such as income, traffic count, and quality metrics. In our approach, precision takes precedence over guesswork. Underwriting is not about conjecture but rather about scrutinizing assumptions at both macro and micro levels. These assumptions are rigorously tested through verifiable data and metrics.

We begin by scrutinizing market rates and comparing them with the quality of the facilities. This comparison extends to factors like population and distance to gauge if the expected outcomes align with the actual market conditions. The data gathered during this process is meticulously compiled and integrated into our underwriting models.

Conclusion

The thorough examination spans various aspects, including asset management and market execution. It's important to remember that due diligence serves the dual purpose of risk mitigation and assumption verification. It is the phase during which red flags are identified and rectified, and where business models are refined and validated.