My Most Profitable Self-Storage Investing Strategy (with numbers)

Sep 15, 2023Today, I want to share the results of my most profitable strategy when it comes to self-storage investing. We talk a lot about how to turn a profit in this industry and the best way to illustrate those profit strategies is to share some of the numbers and results. As they say, the proof is in the pudding.

Typically, there is a notion that high-risk investments yield high returns, such as real estate development. While this is generally true due to equity appreciation, the associated high level of risk often makes investors uneasy.

So, how can we overcome this and avoid investing in properties that generate decent cash flow but take an eternity to recoup the initial investment? Our ultimate goal was to merge these two ideas. Here's how we achieve it. We acquire properties similar to the one you see at the image below, and currently, we have over eight of these projects across the United States.

These properties generate cash flow, but what sets them apart is the vast amount of land they possess. There are acres of land behind these properties, often occupied by vehicles. Our approach involves purchasing these cash-flowing assets, renovating and expanding them. Throughout the expansion process, we continue to generate income, which covers our expenses. By the time all the units are completed, we can quickly fill them since we already have a solid base of cash flow. Moreover, the additional square footage and improved aesthetics command higher rental rates, resulting in increased revenue.

Now, here's the kicker: we acquire this land without paying for it separately. Why? Because the value of the cash-flowing asset is based on its income potential, reflected in the capitalization rate (cap rate). Often, these income-generating properties are more affordable than purchasing the land alone.

Leveraging Cash Flow and Strategic Expansion

A key advantage of this expansion process is that with commercial real estate, you only pay for the rentable square footage. You don't pay for any unutilized space. Since the value is based on net income and cap rate, any vacant land has value but is not factored into the property's worth. This means we can construct additional buildings on these vacant areas without incurring additional expenses, apart from the construction costs.

As we lease out these new units, the revenue they generate directly adds to the net income, significantly increasing the property's value. Meanwhile, the ongoing cash flow from the existing asset covers the expenses associated with the entire property. This exceptional strategy allows us to boost profit margins, increase net income, and maintain a low level of risk since we are dealing with an already cash-flowing asset.

It's important to remember that the main risk associated with development lies in creating properties for which there may be no demand. This could result in empty units and financial losses. However, with our approach, since you already own the property and it is already zoned for development, you can mitigate this risk by gradually expanding, one building at a time.

Rather than constructing a large number of units all at once, we build a smaller portion, such as 20, 30, or 50 units, based on the existing demand. Once these units are leased and there is further demand, we proceed to construct the next phase. This way, we minimize risk by responding to market demand and focusing on specific market segments with proven demand.

In summary, this strategy allows us to maximize profitability by strategically expanding existing cash-flowing properties while minimizing risk. By gradually adding units based on market demand, we ensure a steady stream of income and capitalize on the value appreciation resulting from increased net income.

Acquiring cash flowing assets and expanding them strategically offers the best of both worlds—consistent cash flow and substantial income growth. This innovative strategy harnesses the value of underutilized land, maximizes commercial real estate advantages, and minimizes risk through controlled and targeted expansion.

Transforming a Facility into Profits Through Strategic Expansion

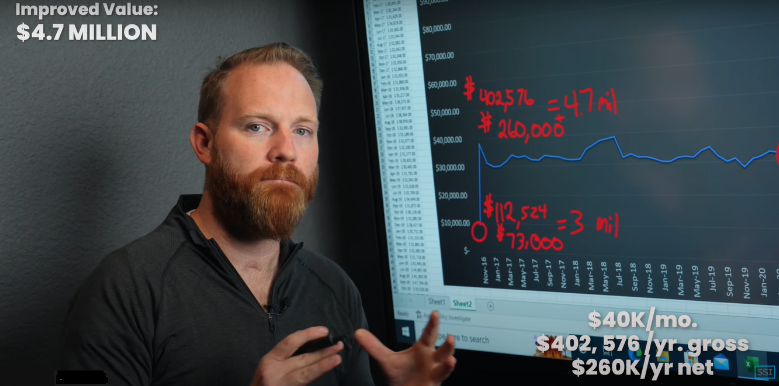

Now, let's delve into the numbers of a facility where we implemented the same strategy. We'll examine the purchase price, what we did, and the resulting returns. You'll also see the revenue chart that demonstrates the progression over time.

We acquired an existing facility through a conversion, and from day one, it was generating cash flow. The initial monthly cash flow stood at $9,000, which is where our revenue chart begins. Our purchase price for this facility was $3 million, which some might consider an overpayment. However, we were confident in our value-add system.

Within just three months, we made significant improvements. We enhanced operations, adjusted rental rates, refined customer acquisition processes, and implemented effective marketing strategies. As a result, the gross revenue soared to over $400,000, generating a net profit of more than $260,000. This substantial increase led to a new valuation of $4.7 million within three months.

With such a dramatic change in value, we secured a loan to finance the expansion of the facility at no additional cost to us. The $260,000 gain covered the expenses of constructing new buildings. As depicted in the revenue chart, there was a temporary drop in revenue due to the removal of some tenants. However, even during this period, the revenue remained over three times higher than our initial purchase amount.

During the subsequent phase, we built out the new units and opened them in July 2020. It took us approximately two years, extending into the following spring, to complete this process. Within one year of the grand opening, by early 2022, our monthly net income reached $80,000, resulting in an annual gross revenue of over $800,000 (accounting for seasonal fluctuations). The net income amounted to more than $600,000, leading to a property valuation of over $11 million.

Here is where things get fun! Since these reported figures, our revenue has continued to rise, highlighting the ongoing success of the strategy. The substantial profits and financial growth demonstrate the true potential of this approach. Our increased revenue from the asset at the time of purchase funded the development of all the units on the property. We were essentially paid to expand and build, which significantly reduced our overall risk. Combining the benefits of a cash-flowing asset with the upside potential of a development is precisely why I hold expansions as my favorite strategy.

The figures clearly showcase the remarkable rewards achievable through this approach, making it an enticing opportunity for real estate investors looking to maximize returns while minimizing risk.

Combining Acquisitions with Expansions for Risk-Mitigated Growth

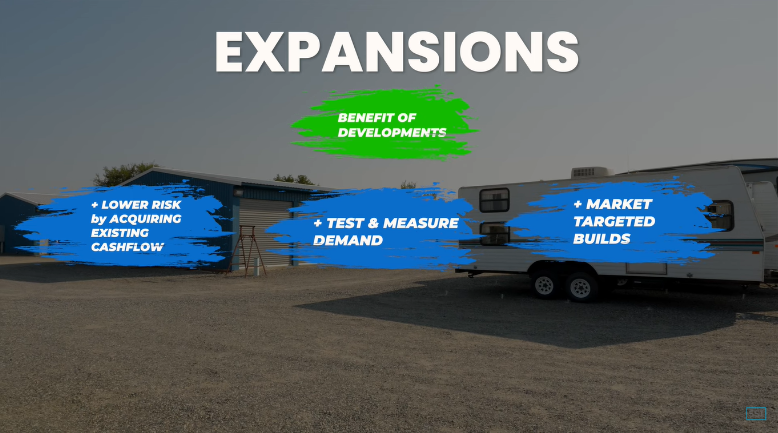

Developments can often be intimidating for newcomers in the real estate industry due to the lack of existing revenue and the challenge of assessing demand. However, by purchasing an already established facility and expanding it, we gain immediate insights into market dynamics. This approach allows us to observe the pros and cons, identify popular units, and determine which ones have high demand and are less price-sensitive. Consequently, we can charge higher rates for those units.

During the initial phase of development, when we bought the facility and turned it around, we conducted market testing. This enabled us to assess which units would be the most profitable and have a lower risk of remaining vacant. This model reduces risk not only through cash flow but also by leveraging the knowledge we gain from the process. It allows us to align our construction with market demand based on our own experience, rather than relying solely on what others are doing. Furthermore, it provides an opportunity to test price sensitivity in the market, offering a significant upside.

Expansions are my preferred model because they combine the advantages of developments with the risk mitigation provided by acquisitions. This approach also allows us to accurately measure and understand market demand, enabling us to make informed decisions about what to build and the appropriate price points for our products. Without this knowledge, entering a market or undertaking a development project can be overwhelming and uncertain. Therefore, conducting thorough market analysis is crucial for comprehending market dynamics, projecting price points, and making informed investment choices.

Conclusion

Our self-storage investing strategy combining acquisitions and strategic expansions offers a compelling solution for maximizing profitability while mitigating risk in the real estate market. By acquiring cash-flowing assets with ample land potential, we leverage the existing income to finance renovations and expansions, all while maintaining a steady cash flow.

Our controlled and targeted approach to expansion allows us to respond to market demand gradually, minimizing the risk of creating vacant units. This innovative strategy harnesses the advantages of underutilized land, maximizes the potential of commercial real estate, and provides a pathway to consistent cash flow and substantial income growth. With our proven track record and innovative approach, we invite real estate investors to explore the possibilities and reap the rewards of this compelling strategy.