The Self Storage Bubble Bust...

Aug 02, 2023434 days ago, I tweeted this….

The self-storage bubble is starting to bust.

Flash forward to today, and The Wall Street Journal is talking about it…

https://www.wsj.com/articles/self-storage-rents-fall-record-amount-as-pandemic-boom-cools-609f6169?mod=Searchresults_pos2&page=1

If you missed my original statement (which I won’t be mad at your for) back on May 4th, 2022 on Twitter and Youtube, I discussed in length how I felt that nobody was addressing the huge risk in the self-storage industry at the time, which was the changing landscape of the economy, how it was impacting the self-storage industry as whole, and lack of overall knowledge.

I thought it was due to self-interest (aka investors wanting the industry to keep booming) but I realized it's something different.

So I tweeted about it.

Here’s what I said in 2022 (and make sure to read all the way to the end to see what I think is happening now….plus be ready for a deep deep dive into the self-storage industry as a whole):

The biggest exaggeration I see in the industry: ‘Self-storage is recession-resistant, ‘Is the lowest deflating asset of any CRE, & ‘is recession-proof’

While the numbers were true, they leave out the fact that self-storage also had the lowest debt to income and equity in 2008.

Why? Because banks didn’t like to lend to self-storage, leaving most assets with no debt or under 50% debt to equity. Many had high occupancies but lost 50% of their revenue. They were giving units out for free or people just stopped paying. But they survived & did well compared to other assets.

Self-storage did not have any major third-party management companies and had never been through a credit crisis so institutional investors did not play in the space (less competition the better, right?).

This created a massively underserved industry filled with mom and pops. Many were simply land holds and the investors didn’t care about operations or maximizing revenue. It had not been through a major expansion like all other assets in the 90s and early 2000s.

After 2008, this all changed.

Big third-party management companies, like ExtraSpace, came out and you could model their self-storage performance, and institutional capital could come in and take over. The CEO of Public Storage said “third party management is the worst thing in the industry and will be its downfall”

Due to a lack of development prior to 2008 and through the recession (combined with low-interest rates and people moving), the demand for self-storage grew. Revenue and occupancy rose and cashflow exploded (due to the low cost & low debt margins).

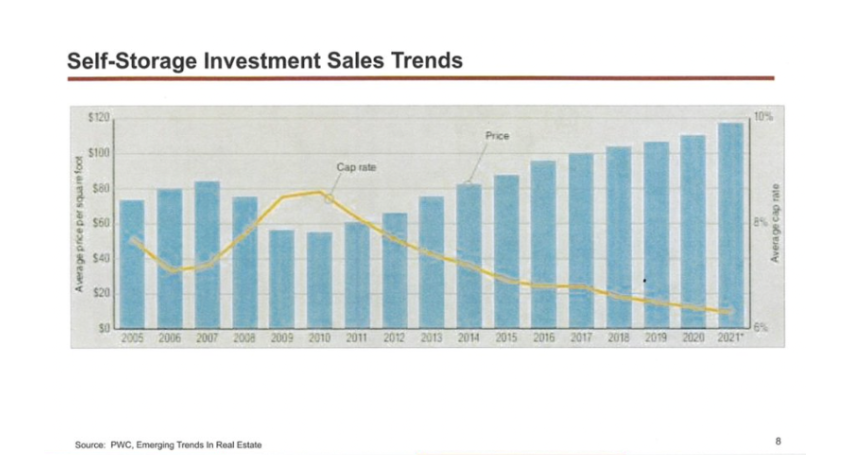

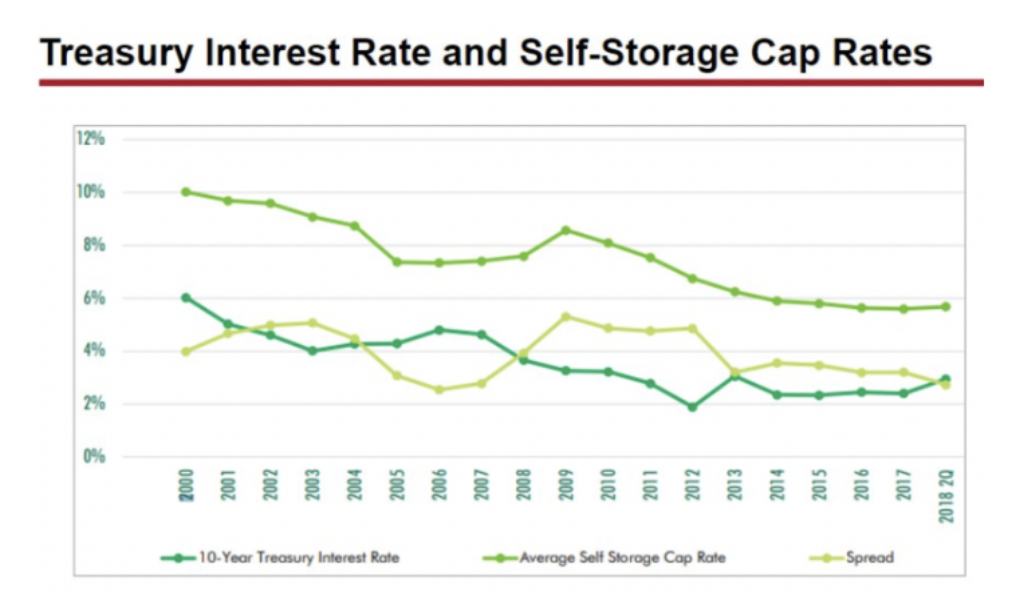

Returns outpaced every other CRE asset. Investors took notice and demand from investors grew rapidly driving costs & dropping cap rates.

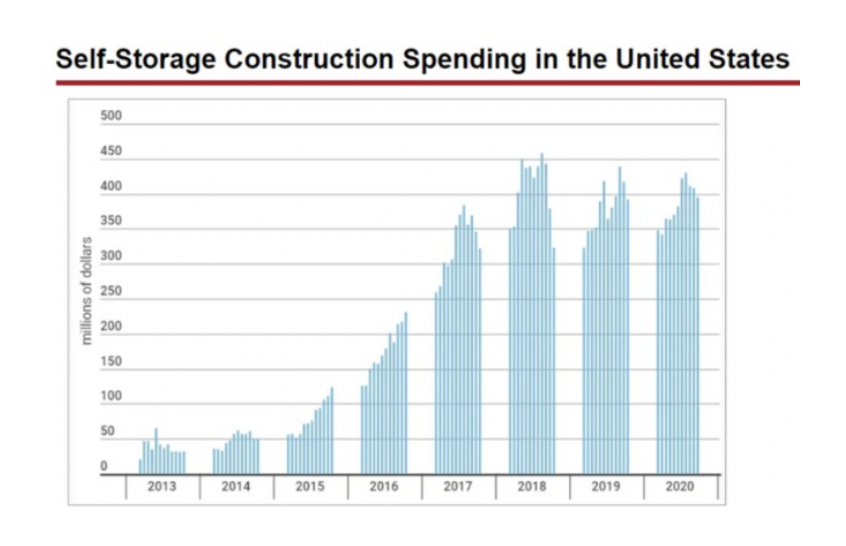

Institutional investors meant higher sales prices and market consolidation. Over the next 15 years, cap rates would go down to never seen levels and price/per sqft would skyrocket. Big money plus low cap rates led to a development boom, unlike anything in self-storage history.

Self-storage was now in a development cycle that other industries had gone through prior to 2008. Debt chased the assets now viewed as extremely safe & everyone took a lot.

Facilities became high-end, out of the industrial park and into nice neighborhoods with expensive add-on services.

Operators became much more sophisticated looking more like hotel companies and leaning on new technology to maximize their competitive advantage.

This is when the players changed. As returns outperformed other asset classes, the real estate community took notice.

After 2016 we saw a big change in the industry that accelerated everything after 2018.

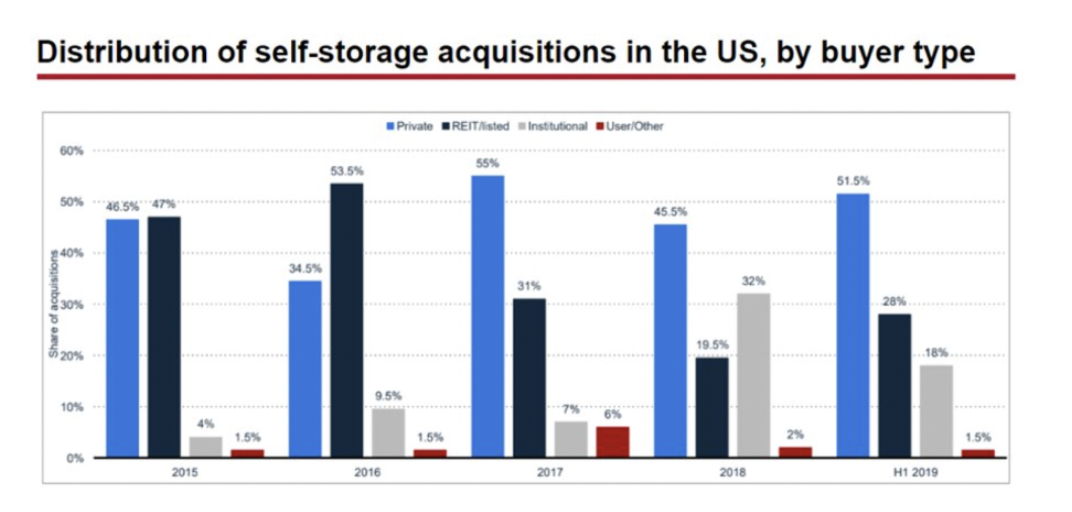

Private equity and new investors all wanted a piece of the self-storage pie. Funds that never operated self-storage dominated acquisitions, paying prices that pushed out the REITs and long-term companies not willing to pay such premiums.

Investors that had never seen a period in which self-storage did not have rising occupancy rates, and lowering cap rates. Their acquisitions, deal structures & underwriting showed this (which is a key point to recognize).

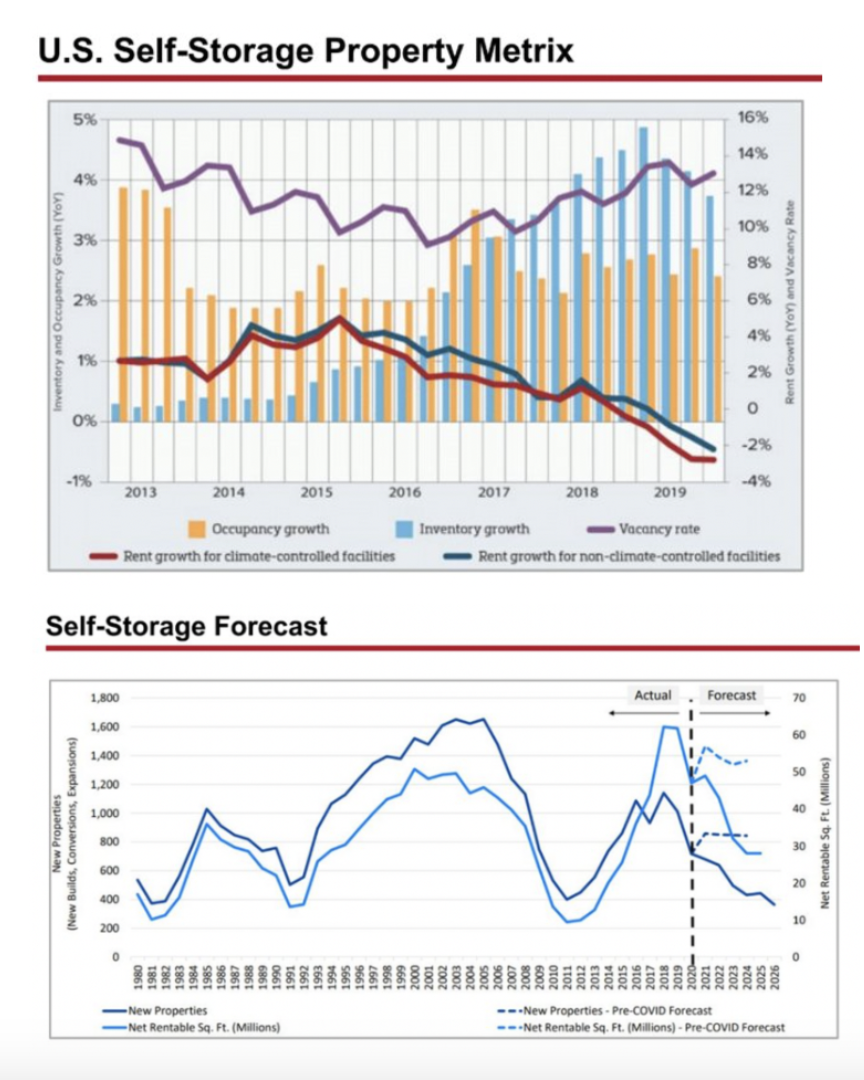

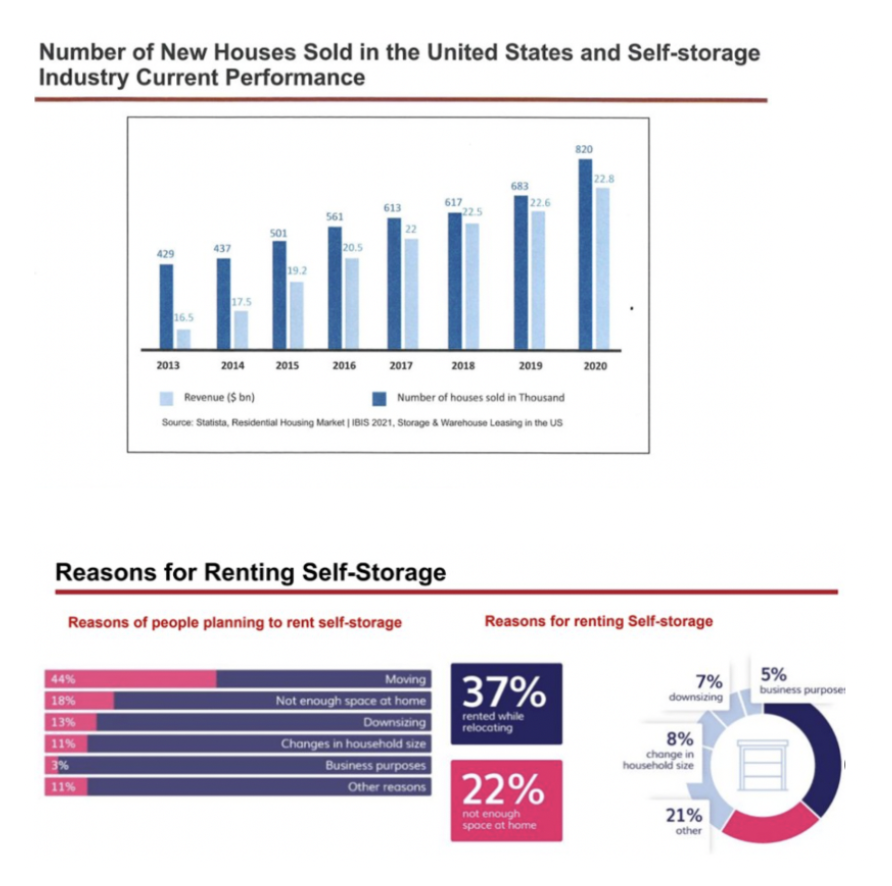

In 2019, we began to see the impact of the development cycle. Occupancy began to fall with revenues. Then the catalyst happened. It came as a savior for many developers that were struggling to fill up at rates that were lower than planned.

Then, Covid hit right at the end of this massive development cycle.

No one would have expected but this was a huge boom for self-storage. Low-interest rates plus people not going to work combined with incomes that stayed in place AND checks from the government?!

People decided to go out and buy homes and toys.

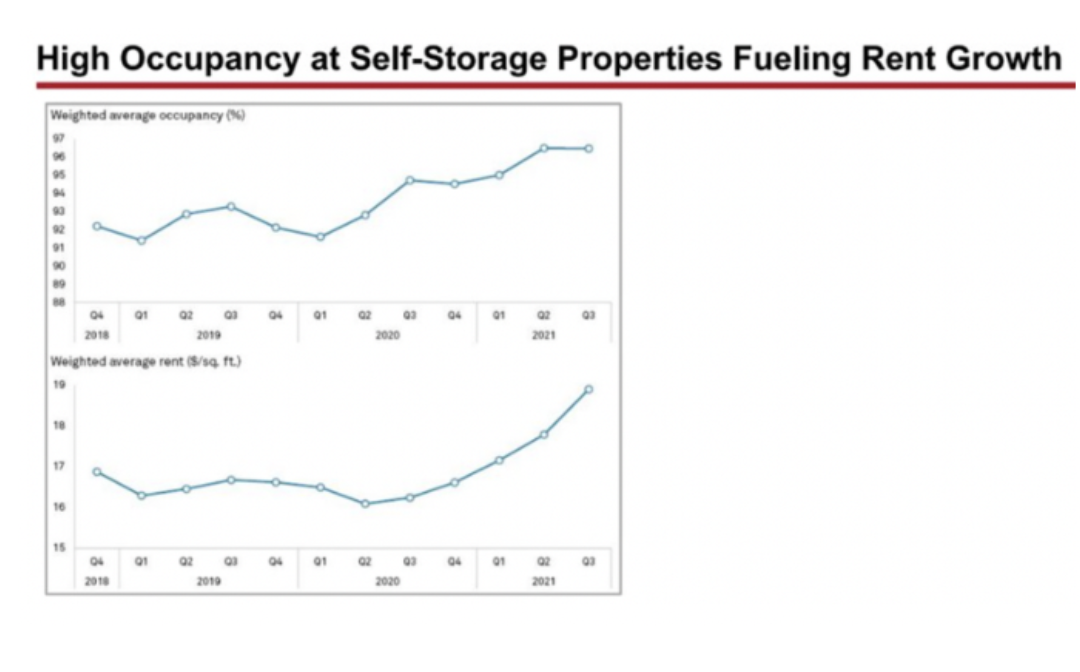

Occupancy rates shot up to levels never seen, and rates followed. Massive rate increases following the lack of space available are going to make the numbers look even better in the short term.

As other assets suffered, investors pivoted even more into self-storage followed by inflation. Investors rushed in and only being in the game for four years, they were raising hundreds of millions of dollars and buying everything they could.

Something to note - self-storage is directly correlated to the housing market. People moving is good. The housing market slows down and stagnation will have a huge effect on occupancy. As interest rates rise and the number of houses sold drops, so will occupancy and revenue.

Investors buying up these assets at these prices are expecting returns to come from a sale at higher revenue, high occupancy, and historically low cap rates.

This type of underwriting takes a future equity conversion event & then applies those returns across the years the asset is held. It is predicated on the event I like to call "event-driven investing".

Also known as gambling.

This becomes the justification needed to pay such high prices. You can build your model to have a great sell price at the end.

So, what did I do in my self-storage business in 2022 in order to make all of this work?

My plan: To get interest-only (IO) loans for the term and then sell. I would never have to pay the principal amount, lowering my expenses massively, so I can get to the sale price and make the deal worth it.

This is the tipping point. Interest rates rise in an over-built market, housing slows, occupancy drops and cap rates rise.

So, if interest rates rise, occupancy goes back down to normal and cap rates rise with interest, the event that you thought is the pot of gold at the end of the rainbow becomes a bomb waiting to explode.

Let me show you an example to reiterate the point:

Gross Revenue: $170k

Net Income: $100k

@ 4 cap = $2.5M

25% down - $1.875M Loan

Drop 10% in occupancy & @5 cap rate value is $1.8M.

That’s a $700K loss.

Even if the facility cash flows, if you need to refinance, you are underwater. In the end, I believe that the long-term value proposition of storage is great! But many will not survive the change that is coming and the return to a more normal mature asset performance.

And guess what?

We're halfway through 2023 and the bubble has officially popped.

The rates we can charge are dropping, along with new customer acquisitions and overall income. So now what? What happens to all the facilities out there that were bought during the previous bull market?

I’m here to tell you that it’s time to be smarter with your strategy. I’m not trying to scare you but understand that self-storage is self-correcting and you have to pay attention to what is happening in the industry right now.