Why Market Demand is MOST IMPORTANT in Self Storage Investing

Oct 27, 2023Today, we will delve into the topic of self-storage demand and its critical role in assessing the viability of such investments. Understanding market demand is paramount when considering the potential success of a self-storage project. A robust demand within the market can often compensate for various shortcomings, while weak demand can hinder even the most skillful operators. To increase your chances of success, it is crucial to ensure that your self-storage venture benefits from consistently high demand.

To achieve this goal, we must first comprehend the dynamics of market demand within the self-storage industry. In this article, we will explore the four key factors you should consider when assessing self-storage market demand: square footage per capita, occupancy, rate history, and future supply.

Understanding Market Demand Dynamics

Numerous factors influence market demand, and understanding them is pivotal for assessing the potential of self-storage ventures. To facilitate a comprehensive analysis, we will present a simplified framework that can be applied across various markets, recognizing the inherent variability in this sector. Market dynamics are ever-changing, with no two markets being identical.

To illustrate this point, consider the following examples: some markets boast a modest six square feet of self-storage per capita, a seemingly reasonable figure, while others offer an abundance of 20 square feet or more per capita, three times the previous example. Strikingly, the latter may experience high demand, while the former might suffer from alarming vacancy rates.

Square Footage Per Capita

In this discussion, we will explore four key aspects that are instrumental in evaluating market demand. Let's begin with the first: square footage per capita. Square footage per capita refers to the amount of storage space available in a given marketplace for the population that lives there.

The range can vary significantly, from three to six square feet per capita to 10, 12, or even 30 square feet. To illustrate, Idaho stands as an example of a state with the world's highest square foot per capita of self-storage. However, it is vital to note that the abundance of storage space does not necessarily equate to high vacancy rates. Various factors contribute to this phenomenon.

Understanding square feet per capita provides a foundational reference point for the subsequent components of our analysis, which we will delve into next.

Occupancy

The second crucial aspect of understanding market demand is the utilization of existing storage space. To achieve a comprehensive grasp of market dynamics, one must assess how the available square footage in a given market is currently being utilized. This assessment hinges on occupancy rates, which provide valuable insights into the market's health.

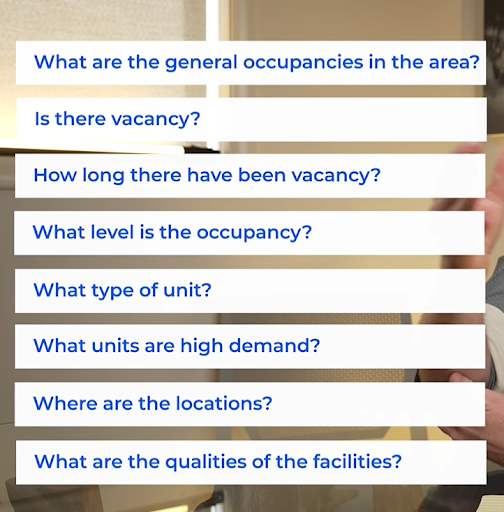

When examining occupancy, consider factors such as the overall occupancy rates in the area, the prevalence of vacancy, the duration of any vacant periods, the types of units in demand, their geographical distribution, and the quality of facilities associated with high or low occupancy. Generally, a prospective investor aims to avoid markets with substantial vacancy rates, as this typically leads to declining prices.

It's worth noting that the period referred to as the "Covid bump" saw occupancy levels rise significantly across the nation, a trend that is not historically typical. Several factors contributed to this surge, including a shift in working patterns, the decluttering of homes, and a boom in home improvement projects. The decline in interest rates and a robust housing market further fueled the demand for self-storage. However, it's essential to determine whether the elevated occupancy rates during this period are merely a result of these unique circumstances or indicative of sustained demand.

To make this assessment, we move on to the third element: rate history.

Rate History

Occupancy is a critical element of market demand assessment, but it should not be considered merely as a static snapshot. To gain a comprehensive understanding of the market's dynamics, it's imperative to examine occupancy trends over time. This extended view provides valuable insights into the demand's sustainability.

High occupancy rates, consistently maintained year after year, coupled with a pattern of increasing rents, signify enduring market demand. When you observe a scenario where occupancy remains consistently high, and rates consistently climb over multiple years, it indicates a robust and persistent demand.

In such cases, rental rates may increase not because of a lack of demand but to strategically manage occupancy, essentially raising rates to encourage turnover and accommodate new tenants. On the other hand, if rates are decreasing, it could signify a desire to fill units, even though it may negatively impact overall revenue.

The fourth and equally significant aspect to consider is the change in future supply. Understanding how the supply of storage space in the market is evolving is of paramount importance.

Assessing Future Supply

In addition to evaluating square feet per capita and current occupancy levels, it is crucial to consider the impact of future supply in the market. Understanding this aspect is instrumental in determining the market's ability to absorb potential increases in storage space.

Imagine that someone is planning to construct a new storage facility nearby, and it's public knowledge that this facility will encompass 100,000 square feet. Now, if you refer to your notes and find that the market currently offers 300,000 square feet of storage space, you'll realize that this impending addition represents a substantial 30% increase in supply. The question that follows is whether the market can genuinely sustain such a significant surge in supply.

This concern is exemplified in cases where individuals intend to build 90,000 square feet in markets that only contain 200,000 square feet of storage. Despite seemingly high demand, it becomes challenging to ascertain whether the market can accommodate 50% more supply than it currently utilizes. It's essentially a guessing game in this scenario.

Conversely, if you are in a market with two million square feet and someone plans to construct an additional 50,000 square feet, it becomes a negligible 2.5% increase. In such cases, the impact on the market is minimal and can be disregarded. As a general rule, when future supply remains below a 15% threshold, it is less concerning, particularly if historical demand remains robust and rates continue to rise. However, when an excessive amount of new supply is introduced into the market simultaneously, it can lead to adverse consequences.

We have witnessed this scenario in the self-storage industry, especially during the Great Recession. While occupancy rates remained relatively high in many cases, some facilities saw their revenues plummet by 50%. To mitigate their struggles, they resorted to steep discounts and giveaways to attract tenants. Although occupancy may have only dropped by 10%, revenues took a significant hit. Consequently, it was an opportune time for investors to acquire such underperforming assets.

You certainly do not want to find yourself in a situation where your facility's performance deteriorates due to an oversupply in the market. Therefore, comprehending the potential influence of future supply is of paramount importance. We gauge this by considering square feet per capita, which provides insight into the market's ability to accommodate new entrants.

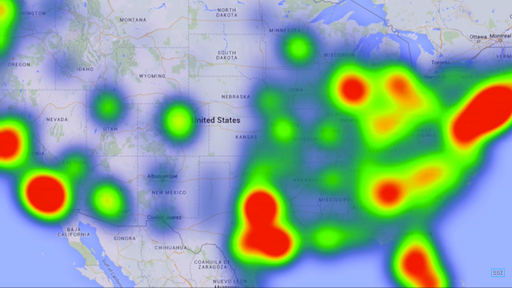

To delve even deeper into this analysis, we employ a heat map to assess demand on a per-unit basis just like the one you see below:

We believe that each unit is a distinct product, each with its unique demand dynamics. For instance, a large RV storage unit is not the same as a 5x5 climate-controlled unit. By understanding the product market fit and evaluating which units are in high demand, we can fine-tune our approach to the market. It's imperative to avoid overbuilding units that the market does not desire.

Understanding Market Growth and Demographics

Many individuals often inquire about the rate of market growth and the influence of demographics on self-storage demand. While various studies and anecdotal claims suggest correlations between certain demographics and higher storage space utilization, the data on these relationships is not always clear. In our observations, the most consistent correlation we've seen is in rapidly growing western markets.

Out west, where people tend to have more outdoor equipment and recreational toys, the demand for storage is higher. This is often due to the lack of basements and the region's strong focus on outdoor activities. Moreover, these western markets typically experience rapid population growth, contributing to higher utilization and occupancies. Fast-growing markets tend to create their own demand, resulting in robust self-storage demand.

In contrast, stagnant markets pose a unique challenge. If a market is not experiencing any growth and you introduce excess supply, the lack of demand means that units will remain empty. In such scenarios, the only recourse is to lower rental rates, leading to a decline in revenue. Thus, it's crucial to avoid oversupplying stagnant markets.

Shrinking markets, where the demand diminishes over time, are markets to steer clear of. In these areas, the demand for storage is progressively decreasing, making them less attractive for investment.

Demographic factors such as homeownership, income levels, or the presence of multifamily housing complexes don't consistently align with self-storage demand. The old adage that multifamily housing drives self-storage rentals isn't always accurate. In fact, the type of housing in a market can influence how storage is used. Suburban areas with larger homes tend to see more extensive utilization of storage space.

Additionally, areas with vibrant downtown sections featuring numerous multifamily dwellings may not adhere to the traditional multifamily-driven storage pattern. In such cases, residents may require smaller storage units. A diverse mix of housing types can be advantageous for self-storage businesses, as it allows for a broader range of products and services to meet the market's varying needs. This diversity can facilitate effective revenue management strategies.

Conclusion

In conclusion, when examining market growth and demographics, the key consideration should be the overall growth rate of the market. Rapidly growing markets tend to exhibit higher self-storage utilization, while stagnant or shrinking markets pose challenges. Demographic factors can vary in their influence, and a diverse mix of housing types can provide opportunities for self-storage operators to cater to a broad range of customers.