Why Occupancy Doesn't Matter in Self Storage

Nov 03, 2023Self-storage facilities have become a ubiquitous sight across the United States and many other parts of the world. These spaces serve as a convenient solution for individuals and businesses to store their belongings, ranging from seasonal items to excess inventory. While many self-storage operators and investors often use occupancy rates as a primary metric for gauging success, this article will explore why occupancy is not the ultimate barometer of success in the self-storage industry.

In the world of self-storage, occupancy isn't the key factor to consider. I'll explain why, even though it may seem counterintuitive at first. It all starts to make sense when we delve into an example involving one of my assets.

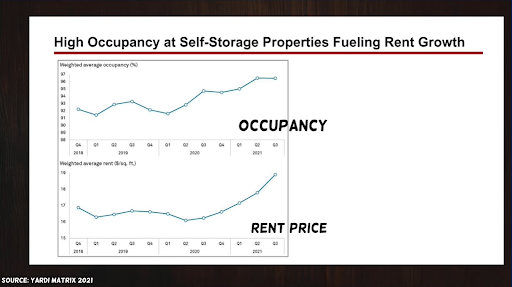

The reason I assert that occupancy isn't the primary concern is because your focus should be directed elsewhere. Moreover, there isn't a direct correlation between occupancy and financial performance. During slower seasons, occupancies tend to be lower. This trend is consistent across the industry, including with Real Estate Investment Trusts (REITs). We're even observing REITs reducing rates by as much as 50% in certain markets. But, does this signify financial losses? Are revenues not increasing? If not, then how and why are they lowering their rates?

Decoding Self-Storage: Understanding the Impact of Occupancy Trends

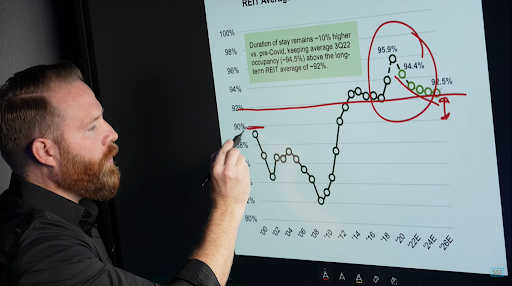

Before we delve into the topic of occupancy and its implications, it's crucial to set the stage. It's important to recognize that the occupancy levels observed in recent years were far from normal.

This was discussed in detail in the video "The Self-Storage Bubble." At the tail end of a development cycle, when the market becomes oversupplied, prices tend to decrease. I emphasized that what we were witnessing was an abnormal situation, and understanding this is key when assessing occupancy trends.

In historical context, the occupancy rates we experienced were unprecedented in the self-storage industry. The 92% occupancy was well beyond anything self-storage had ever encountered. It's vital to grasp that this level of occupancy was never sustainable. We are now witnessing a return to what can be considered a more typical state of affairs. The question is, how much lower will it drop? We anticipate it will stabilize at around 90%, a mark that aligns with Green Street's analysis.

From where we were, this shift represents a significant drop. Particularly for those who entered the self-storage market after the peak, this is a substantial change. Many of these newer players in the industry have never experienced occupancy rates below historic highs. Why is this important? Because their investments were made with the assumption that occupancy would remain at such elevated levels.

High occupancy is closely linked to factors like revenue management and the potential returns on assets. When we analyze investments, we've always focused on revenue management rather than occupancy. In the following explanation, we will delve into why this perspective is crucial, using one of my own assets as an example, despite the fact that its current occupancy is lower than the historic peak.

Unpacking the Dynamics of Economic and Physical Occupancy in Self-Storage

To gain a deeper understanding, let's distinguish between economic and physical occupancy. The concept is relatively straightforward: physical occupancy pertains to the actual units that are rented, while economic occupancy considers the overall financial performance.

In practical terms, think of physical occupancy as having a hundred doors available and ninety of them being occupied by renters. This results in a physical occupancy rate of 90%.

Economic occupancy, on the other hand, factors in the revenue generated from those rented units. Suppose you charge $100 per door. Over time, you might offer discounts, deal with delinquencies, and make rate adjustments. This means that while some units fetch $100, your average income per door may be closer to $70. In this case, your economic occupancy aligns with the $70 average revenue you're receiving from occupied units.

Now, let's apply this to an asset I've owned for just under a year. When we acquired it, the physical occupancy was in the range of 95% to 100%. Simultaneously, the economic occupancy stood at around 75%. Over the past year, our physical occupancy has dropped significantly, hovering around 85% or lower. However, during this same period, we increased our economic occupancy to match our physical occupancy. In other words, we were able to charge $100 per door and actually collect $100.

Now, I'll demonstrate how our revenue evolved despite losing over 15% of our tenants.

Maximizing Self-Storage Revenue: Shifting from Occupancy to Economic Success

During the period when we experienced a 15% drop in occupancy, we managed to increase our monthly revenue substantially. We boosted it from roughly $30,000 to approximately $60,000 per month, effectively doubling our income. It might be tempting to assume that this revenue increase was solely due to doubling everyone's rent, but that's not the case. When we analyze our rents on a per square foot basis, they only went up by 19%. Nevertheless, our gross revenue saw a remarkable 63% increase.

The key to this success lies in our shift from obsessing over physical occupancy to prioritizing economic occupancy and factors affecting revenue. We addressed delinquencies, applied revenue management strategies, and implemented both external and internal rate increases to optimize our income. This approach enabled us to double our revenue while only increasing the per square foot rent by 19%.

This transformation is immensely powerful. If our sole concern had been occupancy, we might have raised it by a mere three or four percent when we initially acquired the property. This limited approach would never have yielded the significant revenue growth we achieved. To an external observer, it might seem that our facility was underperforming because it had 15-20% fewer tenants than before. However, when we assess the situation, we see outstanding performance. Importantly, this increase in revenue did not come with a rise in overall expenses; thus, it directly contributed to the asset's value, as asset value is tied to net income.

It's important to note that this revenue boost did not require substantial capital expenses; it was primarily a revenue-focused strategy. For a more comprehensive understanding of how we employ revenue management and make these adjustments, we have additional YouTube videos available for reference.

Conclusion

In summary, don't fixate on occupancy alone; concentrate on revenue, and you'll unlock substantial potential and value from your assets. While it may be unnerving to witness a drop in occupancy, understanding the "why" behind it is crucial. We've conducted an in-depth video that explores this topic, providing insights into the current market dynamics. You can access it to gain a comprehensive understanding of what's happening in the industry today.